Back taxes is a complex issue. If you underpaid on your taxes or failed to file them properly, you may owe money to the IRS or your state or local tax agency. These collectors are diligent in pursuing their debtors. If you fail to address your back taxes, you could face a lien or levy that can result in garnished wages or the loss of major assets like your home. It’s important to address tax issues as quickly as possible, which is where a back tax assistance company like Community Tax can help.

Many potential clients are concerned about a Community Tax back tax assistance scam. However, this is a legitimate business that’s equipped to help you manage your taxes. If you’re struggling with outstanding back taxes, read on to learn how Community Tax can help.

Community Tax has an outstanding rating of over 4.5 stars from Solvable. Satisfied clients have glowing compliments for this back tax assistance company. Stephen R. says, “They have always been helpful and have been willing to help out with any question or any doubt, special thanks to Saul who was always there to help and to listen.”

Louis R. commented that “I liked both the service and the resolution. I have already recommended to my friends.” Other reviewers share similar sentiments, indicating that Community Tax was personable, knowledgeable, and accessible. Most importantly, many customers who completed a back tax assistance program with Community Tax felt that the resolution was worth the time, effort, and expense that they invested with the company.

Community Tax has a 9.4 Solvable score which is based on a combination of customer feedback and expert ratings.

Community Tax is a Chicago-based company that’s been in business since 2010. The company has been accredited by the Better Business Bureau since 2015. Community Tax began as a tax resolution company connecting customers with CPAs, attorneys, and enrolled agents who could help clients deal with outstanding back taxes. Since its founding nine years ago, Community Tax has grown significantly and now offers a full range of tax services.

See More >> I Paid off $150,000 of Debt - Learn Her Secrets!

Customers working with Community Tax can manage all of their bookkeeping and tax needs through this company. Dedicated tax preparers are available to help clients file their regular taxes each year. Completed taxes are reviewed by a CPA and a member of the Community Tax tax return review team for quality assurance. All returns come with an audit guarantee, so you’re protected long after you submit the initial filing.

Community Tax offers a full range of bookkeeping services for small- to medium-sized businesses as well. This can help companies stay ahead of their tax needs by investing in the services of professional accountants who will keep track of income and expenses throughout the year. This ultimately streamlines tax preparation each year and ensures that all applicable funds are accounted for.

Community Tax still assists customers who need help with back taxes or other issues with the IRS and local tax authorities. This company provides a custom solution for each client that directly addresses their individual tax resolution needs. Learn more about the specific tax resolution services available from Community Tax in the sections below.

All services from Community Tax are guided by a three-part mission statement. This specifies that the company is dedicated to providing service that is:

Integrity, innovation, and excellence are the core community values at Community Tax. Honesty and transparency are highly valued. While Community Tax strives to provide fresh solutions, they also deliver candor that respectfully informs each customer of what they can expect from their tax services. The company’s dedication to excellence inspires them to take responsibility for errors and commit to an environment of learning and improvement.

The Community Tax vision statement outlines a long-term goal to set the industry benchmark for efficiency and value. Its short-term vision is for a business that’s evolutionary, leveraging the latest technology and solutions to provide fresh options for clients. Community Tax is data-driven, using clear benchmarks to measure its success. Its agile approach to the industry allows Community Tax to adjust its approach as needed to consistently excel in its services. Accountability is crucial to the company as well, with each professional taking full ownership of their work.

See More >> How One Woman Crushed $300,000+ of Student Loan & Mortgage Debt

The team of tax professionals on staff at Community Tax includes enrolled agents, tax practitioners, and CPAs. These employees have varied backgrounds that include degrees in accounting, law, and business administration. Many agents are bilingual to better serve Community Tax’s diverse client base. This company has a long history of leveraging these professionals’ expertise to provide affordable and effective tax solutions for clients across the country.

Community Tax offers a full range of back tax assistance services that can help you if you’re facing outstanding taxes, tax liens, tax levies, and other problems. Understanding the options available to you can help you select the right solutions for your needs.

Community Tax offers a free consultation to help you better understand how this company can assist with your tax needs. You can call Community Tax directly to speak with a tax practitioner, or submit your contact information online and have a Community Tax team member call you back. Providing your phone number to Community Tax grants them permission to contact you with text messages, prerecorded messages, and automated system communications as well.

During your tax consultation, you will discuss your financial needs. Whether you’re interested in standard tax preparation services or need a complex plan for resolving a significant amount of outstanding debt, Community Tax can suggest a solution. This consultation will give you a better understanding of all the services that are available to you as well as how they work.

If you need a multi-step approach to tackling your tax problems, your tax practitioner will outline these basic steps for you. This is the ideal opportunity for you to ask questions and explore alternatives. You may find that there are multiple approaches you might try to resolve your issues. You will not pay for your consultation, but you may learn more about the anticipated costs associated with the services that you need.

Community Tax prides itself on transparency in pricing. Its services are available at a fixed cost, which means that you don’t have to worry about hourly rates or added fees. The price that you’re quoted for a service won’t change based on the amount of time that it takes a tax practitioner to finish the job. This helps you budget accordingly for what’s ahead.

See More >> Trustworthy Tax Relief Companies + Customer Reviews

This complimentary consultation service allows you to easily compare different back tax assistance companies. We encourage you to explore several options before settling on the right tax resolution service for your case.

Community Tax offers a variety of tax settlement and negotiation services that will help you deal with any type of outstanding back taxes. This takes place in a three-step process:

There are several services available from Community Tax that your tax practitioner can utilize to deliver a carefully tailored solution for your issue.

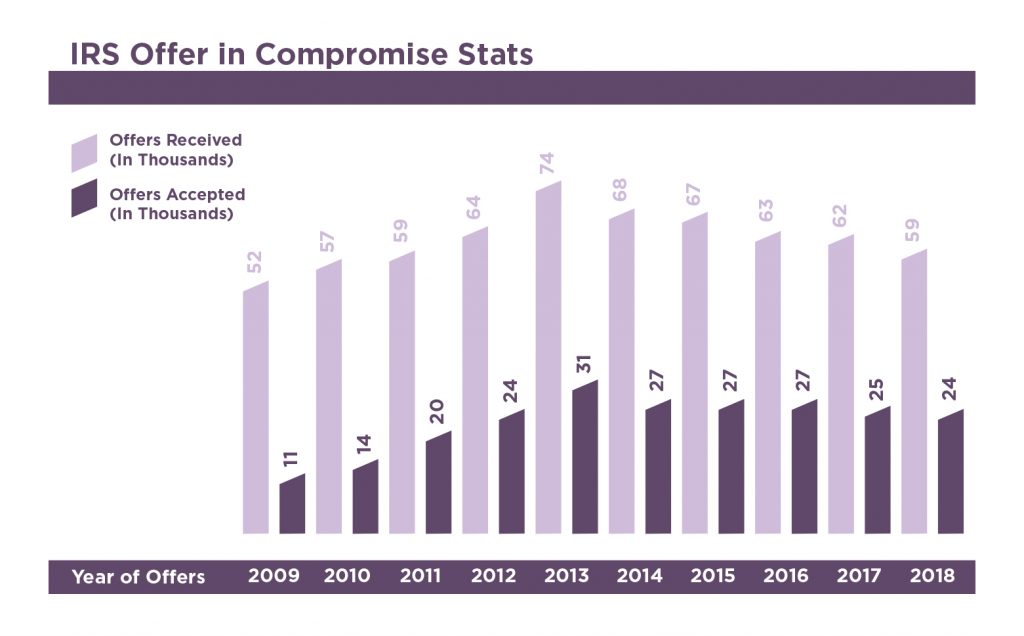

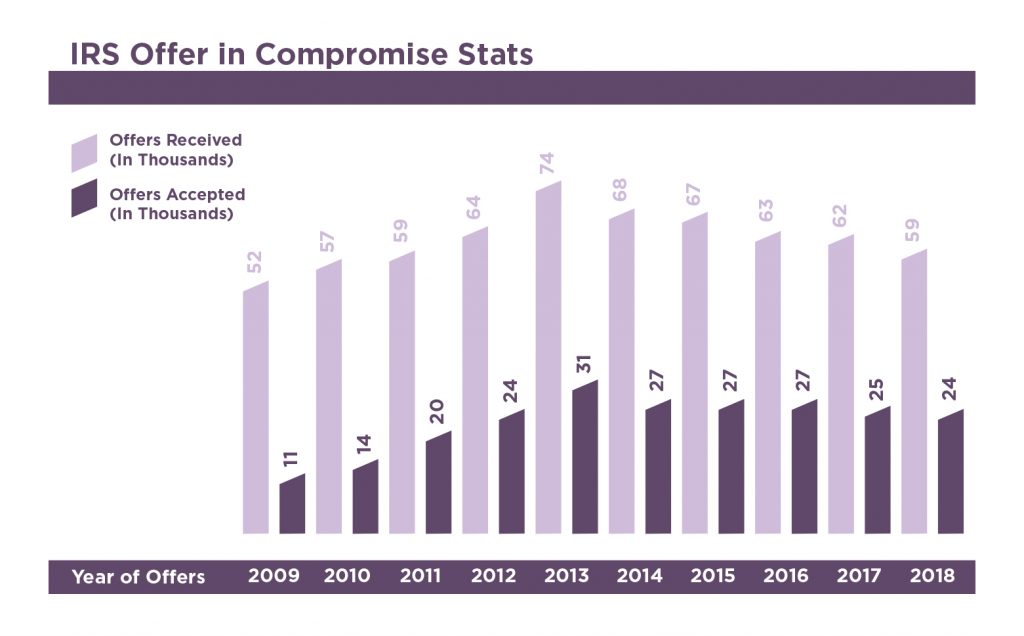

If adding your back taxes to your current debts would create a financial hardship, you may qualify for an offer in compromise. When you file an offer in compromise, the IRS evaluates your financial situation and determines how much you can afford to pay without facing significant hardship. You must pay this amount, but the remainder of your back taxes is forgiven. Community Tax may be able to help you secure an offer in compromise, which eliminates your back taxes for an affordable lump payment.

If your back taxes are weighed down with penalties, Community Tax may be able to help you eliminate some of these. Their penalty abatement assistance services help you explore whether you can have some of your tax penalties removed from your account. If you can prove that uncontrollable reasons caused you to miss a payment or filing deadline and show that you’re actively working to pay your balance and file all necessary forms, the IRS may offer abatement for certain penalties.

An installment agreement allows you to pay off your back taxes through a series of small affordable payments. These can spread your taxes out over a period of time lasting from six months to 10 years. The amount that you’re required to pay each month is based on your financial situation. The IRS considers your personal assets and the sum of your debt when establishing installment agreements.

See More >> Jen Paid Off $42,000 in Credit Card & Medical Debt...

In addition to the traditional installment agreement outlined above, there are some other options that are tailored to more specific financial situations. Community Tax can help you decide which is right for you.

If you’re unable to pay your basic obligations, the IRS may declare a financial hardship. While you are under financial hardship, your tax collections are placed on hold. You must continue to file your tax returns and provide any requested information to the IRS. If you remain in financial hardship for 10 years, your back taxes are no longer collectible and you’re relieved of the burden.

Community Tax can assist with tax resolution in a variety of ways. First, they can help you determine whether you’re liable for the back taxes to begin with. If you receive a notice of deficiency from the IRS, this indicates that the government has determined that you owe additional taxes. In some cases, this is an error. You have 90 days to dispute the claim if you believe that it’s incorrect.

The tax professionals at Community Tax can assess your case and determine whether you do owe the taxes. If you have a solid case for a dispute, Community Tax can help you prepare the claim so you have the greatest chance of winning the appeal.

Community Tax can also help clients navigate the Fresh Start Program. Under this program, you may qualify for penalty reprieve, an installment agreement, an offer in compromise, or tax lien withdrawal.

If you’re facing tax penalties or charges that you don’t agree with, Community Tax can work on your behalf to determine what you should owe. These professionals will help you understand your outstanding back taxes, minimize it where possible, and come up with a manageable plan to resolve what you do owe. This will help you avoid tax liens and levies which give the government the right to seize your property, levy your wages, and place a lien on the assets in your bank account.

See More >> She Paid off $200,000 in Debt & She's Telling You How

Community Tax’s team of CPAs and enrolled agents has worked with thousands of tax returns, so you can enjoy the confidence of working with someone who has extensive experience with the complexities of taxes. You will work with a dedicated tax practitioner who is assigned to your case.

To simplify the process, Community Tax provides you with a questionnaire that you will complete with all the essential information necessary for your taxes. Once you have provided your information to Community Tax, you will receive a call within 24 hours to start the process of filing.

This company can assist with all types of income, including rental income, unemployment compensation, lottery income, dividends, stock sales, social security income, and more. They can also help you identify all applicable deductions, including education expenses, gambling losses, real estate taxes, student loan interest, and charitable or IRA contributions.

Community Tax offers an intuitive app that will help you manage your taxes throughout the process. This app gives you instant access to your tax documents. You can also use it to send direct messages to your tax practitioner if you have a question. The app accepts e-signatures as well, so you can complete your taxes with a few simple swipes when they’re ready. Upon completion, you will receive a full copy of your taxes to review. When you’re satisfied, you simply send this back and Community Tax will handle the filing.

You can take both individual and corporate tax returns to Community Tax for assistance. The company also offers custom solutions tailored to your needs. Their services can help assist with audits, inheritance taxes, estimated tax payments, estate taxes, and other complexities. Community Tax maintains an extensive Tax Form Library with all the paperwork you need to deal with your individual tax situation.

Community Tax has resolved over $700 Million in back taxes for their clients. Working with the right company can help you save a significant amount on owed taxes. Community Tax can help you negotiate an offer in compromise that could potentially save you thousands on your back taxes.

A primary concern for most new clients is how much does Community Tax back tax assistance cost. The cost for services from Community Tax varies depending on your needs. The average fee for an initial investigation into your back taxes is $250 to $500. The additional fee for back tax assistance services typically ranges from $2,500 to $4,500. These services are best for clients with at least $7,000 in back taxes, so your potential savings are greater than any costs incurred by working with tax professionals.

Community Tax does not publish its fees online. Rather, it assesses costs on a case-by-case basis. These numbers are based on averages from information provided by past clients. This data also indicates that tax filing for W-2 returns is about $275 and assistance with Forms 1099 and 1040 costs about $525. Business tax returns typically cost around $1,000. A free consultation is the best way to determine what your back tax assistance services will cost. Community Tax provides its services for a fixed cost, so you don’t have to worry about additional fees or hourly rates once you’ve received a price.

Each month, Community Tax settles nearly $1 million in total back taxes for its clients. The company assists in the release of dozens of levies and liens and closes an average of 1,000 tax cases per month. With this level of experience on your side, it’s likely that you’ll receive a favorable outcome. However, it’s important to understand that every case is unique and there are some instances where Community Tax cannot resolve your debt or set up your preferred payment plan for you.

During your consultation, you should discuss the likelihood of success with your case. Make a note of the options that are available to you and evaluate your personal finances independently to determine whether you’re likely to qualify for these payment plans. The more information you have on hand during your consultation, the more accurate your quote will be. Make sure you have all your tax documentation and financial details ready when you call for your consultation.

You can get started with Community Tax in just minutes by calling them for a free consultation. If you choose to use their services, you can expect your back tax assistance program to take several months. The average case lasts about four months.

You have the option to decline services from Community Tax and receive a refund if you decide that you’re not happy with the service within the first few days. The allowable time for a refund varies by state and ranges from three to 10 days. After the refund period has expired, you must continue with your tax resolution, even if it takes longer than anticipated.

You can help your tax practitioner resolve your case more quickly by providing any requested information as quickly as possible. When you’re filing for tax resolution, you should expect to provide a great deal of information about your personal finances. This may include details on your income, assets, and other debts. If you’re currently engaged in a payment program for another debt, providing details on this may help you qualify for certain types of repayment plans.

The response time of the IRS can impact the duration of your case as well. If you’re disputing back taxes, you may have to wait several months simply to receive a response from the IRS or state government agency that you’re dealing with. Factors such as these are beyond the control of your tax practitioner.

The Better Business Bureau (BBB) is a marketplace where buyers and sellers can gain valuable information about the businesses they’re interested in working with. The BBB provides basic details on the business as well as customer reviews. Researching a company through the BBB can prevent unsatisfactory outcomes. However, customers who do have complaints can work with the BBB to resolve them. The BBB employs consumer service specialists who contact businesses on behalf of dissatisfied consumers to provide resolutions.

Community Tax has an A+ rating with the BBB. This rating is based on:

Businesses receive a score between 0 and 100. To receive an A+ rating, as Community Tax did, the company must have a score between 97 and 100.

Though Community Tax has been accredited by the BBB since March 1, 2015, it does not have any customer reviews or customer complaints filed with the agency. This makes it difficult to assess its practices in depth. However, customer reviews are available on other sites that offer more insights into how Community Tax does business. These are mostly positive.

You can check the Community Tax’s BBB business profile at any time to see whether new reviews or complaints have been posted. It’s a good idea to compare business’ ratings and reviews when you’re in the process of selecting a back tax assistance company so you can make your choice confidently.

To receive your free consultation with Community Tax, you should call the company’s primary number. You can call at Community Tax at 855-336-2769.

Community Tax is located at:

Chicago Loop

17 N. State St. Suite 210

Chicago, IL 60602

You do not have to visit the company’s physical address to receive back tax assistance services. These are available online and via phone. Community Tax’s mobile app can assist with many tax services as well. Customers from around the country have worked successfully with Community Tax.

If you’re facing issues with back taxes, it’s important to know where to turn for help. While you may be able to resolve small debts on your own, major debts are best addressed by a professional. Community Tax can help you find the best approach to your debt so you can resolve your tax issues and improve your finances.

See More >> I Paid off $150,000 of Debt - Learn Her Secrets!