At Solvable, we care about your financial well-being and are here to help. Our research, articles and ratings, and assessments are based strict editorial integrity. Our company gets compensated by partners who appear on our website. Here is See More

In today’s media, there is a lot of discussion about the student loan and mortgage crises but the issue of unpaid back taxes, sometimes referred to as tax debt, is a topic that receives little attention – despite affecting over 11.2 million Americans, according to a 2019 IRS report.

Taxpayers who owe money to the IRS can face serious consequences if they do not pay their outstanding tax balance. Collection activity by the IRS can be intimidating and frightening for taxpayers, escalating in severity from tax liens to wage garnishments and ultimately property seizure to cover the balance owed.

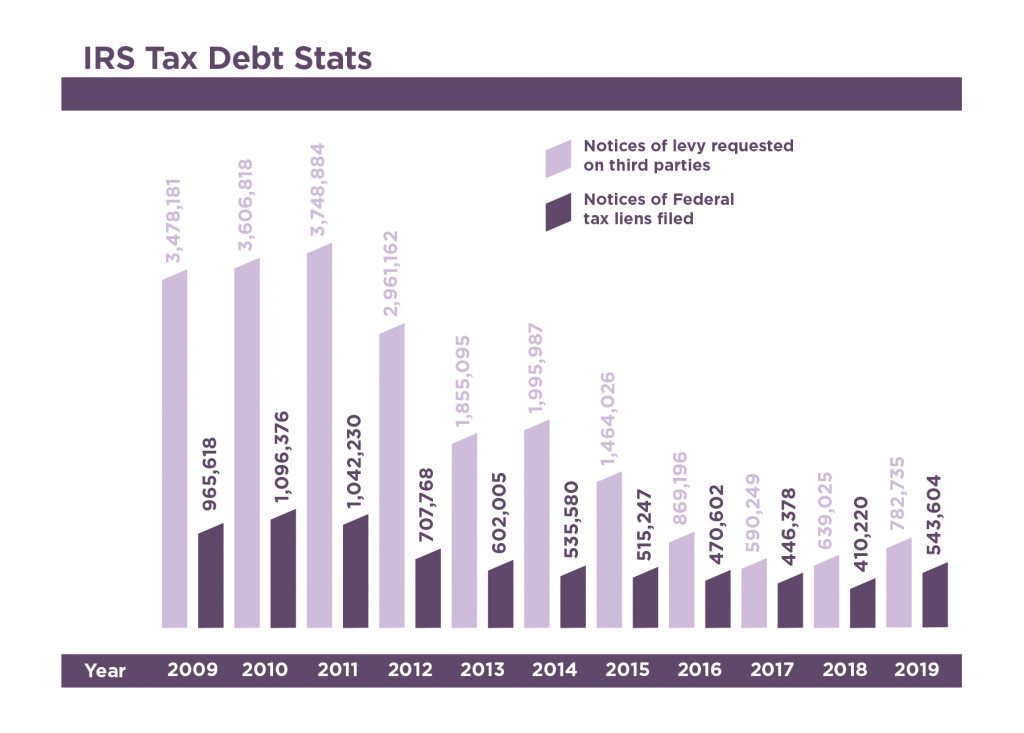

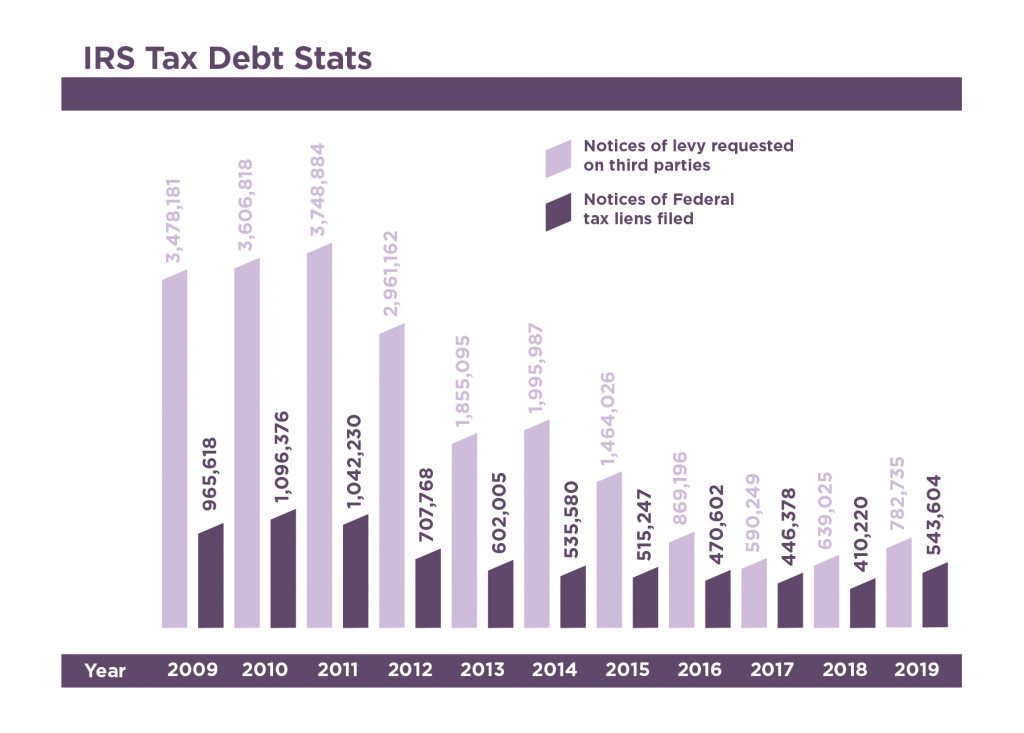

Using IRS data, Solvable & GoBankingRates tracked the enforcement & settlement activity on unpaid back taxes over 10 years from 2009 to 2019*. We looked at 3 different judgments assessed:

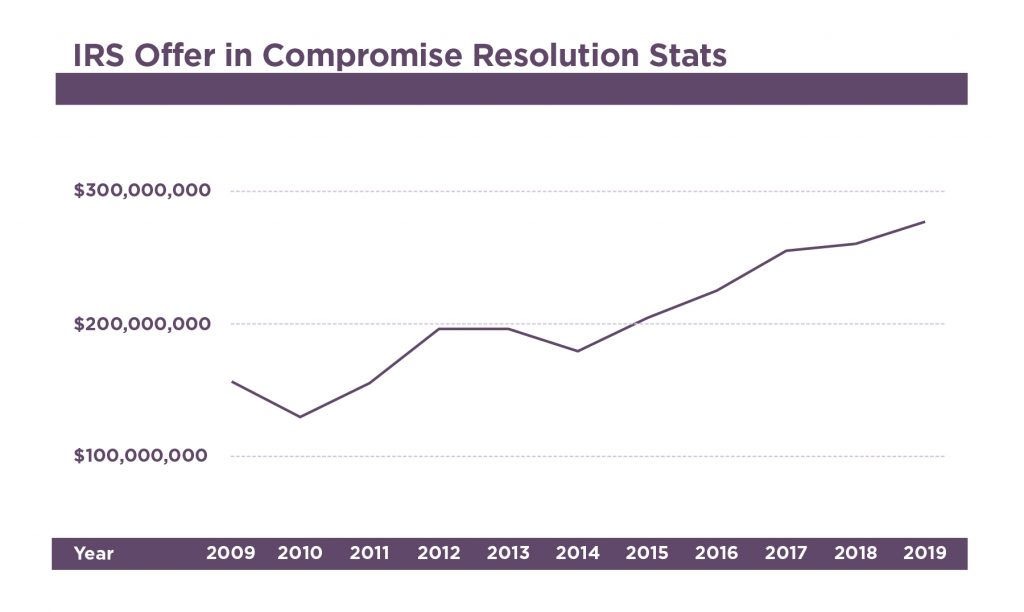

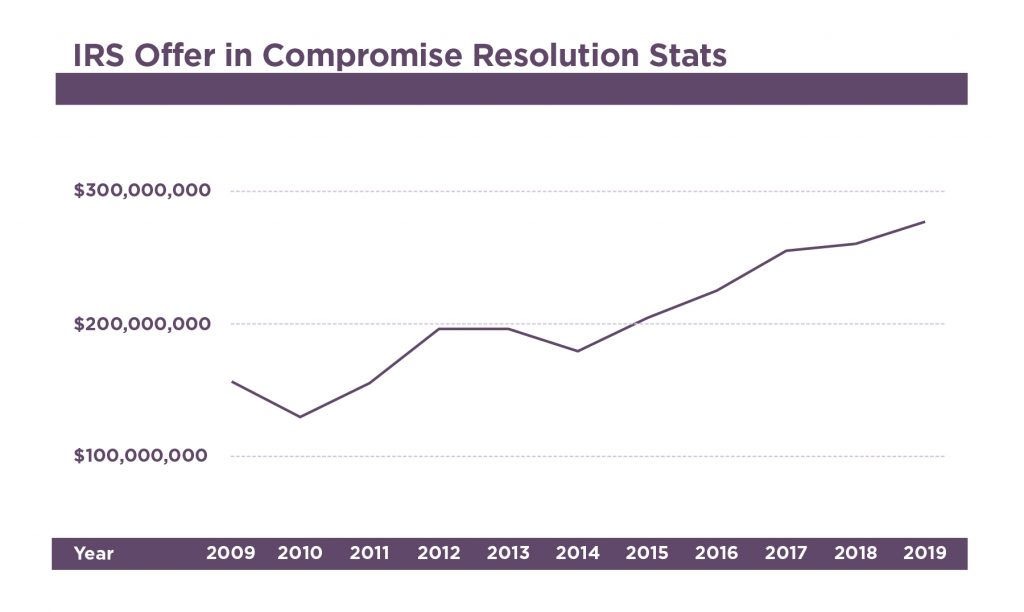

Over this period, we found that the overall number of federal tax liens filed reduced by more than 50%. In fact, as enforcement activity has decreased, settlement activity has almost doubled over the past decade. The availability of federal programs like the Offer in Compromise allows taxpayers to settle their tax obligation for less than they actually owe.

In this report, we also tracked the settlement activity through an Offer in Compromise, looking at:

There are several requirements to qualify for this program, which was created to help those in hardship situations who cannot reasonably cover their outstanding balance. In 2011, the IRS created the Fresh Start Initiative (also known as the Fresh Start Program) to help struggling taxpayers who simply could not pay their amount owed. Using programs like the Offer in Compromise, taxpayers are afforded more opportunity to solve their back taxes. With back taxes becoming increasingly problematic, the IRS recently expanded the qualification requirements for the Fresh Start Program, allowing more taxpayers to get the help they need.

See More >> This Guy Resolved $8,597 in Back Taxes - Learn His Methods!

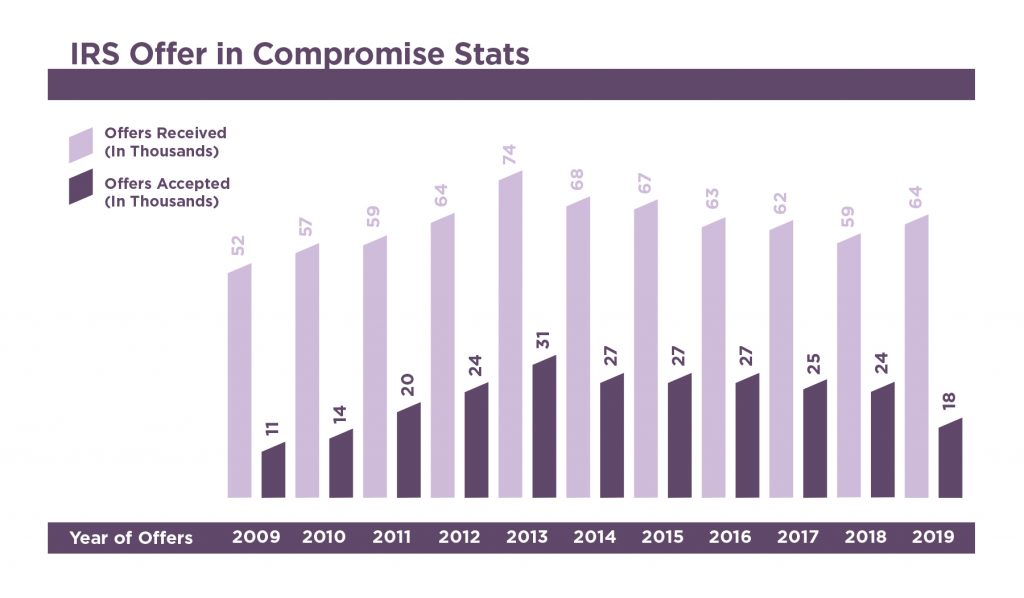

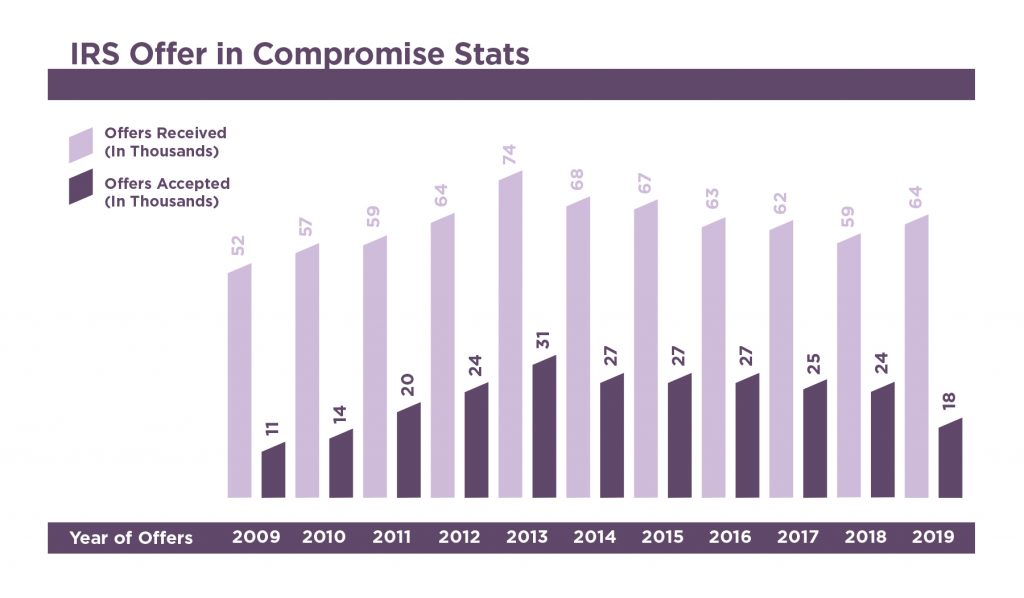

The acceptance rate for the Offer in Compromise program nearly increased from 21% in 2009 to 33% in 2019. The amount of offers accepted has also increased over the past 10 years, by over $130 million, suggesting that now, more than ever, there are solutions for taxpayers struggling with back taxes.

If you owe back taxes to the IRS, they will take several steps to collect on the debt. First, they will mail you several notices alerting you of the outstanding balance. If you fail to respond to the letters or pay your balance, the IRS can issue several judgments against you to collect the amount owed.

These letters can be threatening and scary for the recipient, and Solvable recommends anyone who has received one of these letters to seek help from a qualified tax professional immediately. The enforcements we’ll be exploring in the report are tax liens, tax levies and property seizures.

The first (and least serious) enforcement action is called tax lien. An IRS Tax Lien is the federal government’s legal claim to property to collect on outstanding tax debts, or back taxes. This is a claim against the property, not an actual seizure. Though a tax lien may seem like it is just “on paper”, having one prevents the recipient from getting a new mortgage, refinancing their home mortgage or selling their house. Once a tax lien is filed, it attaches to all owned assets including property, securities, and vehicles. If not addressed, it could lead to a Tax Levy.

See More >> How One Woman Crushed $300,000+ of Student Loan & Mortgage Debt

The final enforcement action issued if taxpayers do not pay their back taxes is a tax levy, sometimes also referred to as a bank or wage levy A levy gives the IRS the legal right to seize property or money from a bank account to pay off the debt. One of the more common forms a tax levy takes is a wage garnishment, the government’s legal right to intercept wages or other sources of income, like Social Security payments, and use the amount garnished toward the outstanding balance.

As a last resort, the IRS has the ability to actually seize property owned by delinquent taxpayers and use profits from the sale of the asset to cover the balance owed. This is an extreme option and the IRS is required to give a 30-day notice prior to actually seizing any assets, allowing taxpayers time to respond or seek help.

Over the past 10 years, the IRS has filed 7.3 million liens against taxpayers. This number peaked in 2010, with 1,096,376 tax liens filed. Since then the number steadily decreased year-over-year, dropping by 50% by 2019. In 2019, for the first time in 8 years, the number of tax liens filed exceeded the year prior.

The drop in tax liens filed in 2011 coincided with the introduction of the Fresh Start Program, which changed the process for federal tax lien filings. Prior to this, even taxpayers with lower back taxes totaling a few thousand dollars could receive a tax lien. Under Fresh Start, the IRS can only file a tax lien against taxpayers who owe $10,000 or more. As a result, many Americans owing $9,999 or less were reprieved in the years following resulting in the lower number of liens filed.

The Fresh Start program also introduced a way to avoid a federal tax lien, even for those who owe $10,000 or more. The IRS will not file a lien against those who owe less than $50,000 and have set up a streamlined installment agreement to cover their balance owed.

The Fresh Start Initiative, also helps taxpayers deal with existing tax liens. Those who wish to have their tax lien withdrawn can do so can apply, given the following –

See More >> Trustworthy Tax Relief Companies + Customer Reviews

Here are the number of federal tax liens filed each year:

While a tax lien is simply a claim to property, a tax levy grants the IRS complete ownership of the property to satisfy the amount of taxes owed. It can be placed on a number of different accounts including but not limited to “wages, retirement accounts, dividends, bank accounts, licenses, rental income, accounts receivables, the cash loan value of your life insurance, or commission,” according to the IRS website. For this reason, tax levies are sometimes synonymous with wage or social security garnishments.

From 2009 to 2019, the IRS requested a tax levy be placed on 21,991,358 taxpayer accounts. In 2011, the agency placed 3,748,884 tax levies on delinquent accounts – the highest of all 10 years. By 2017, the number of tax levies requested had fallen 84% to 590,249. The number started to increase in 2018, and again in 2019.

Although the Fresh Start Initiative did not make any changes to the tax levy process, it did grant taxpayers the right to have their levy removed if certain program requirements were fulfilled.

See More >> Jen Paid Off $42,000 in Credit Card & Medical Debt...

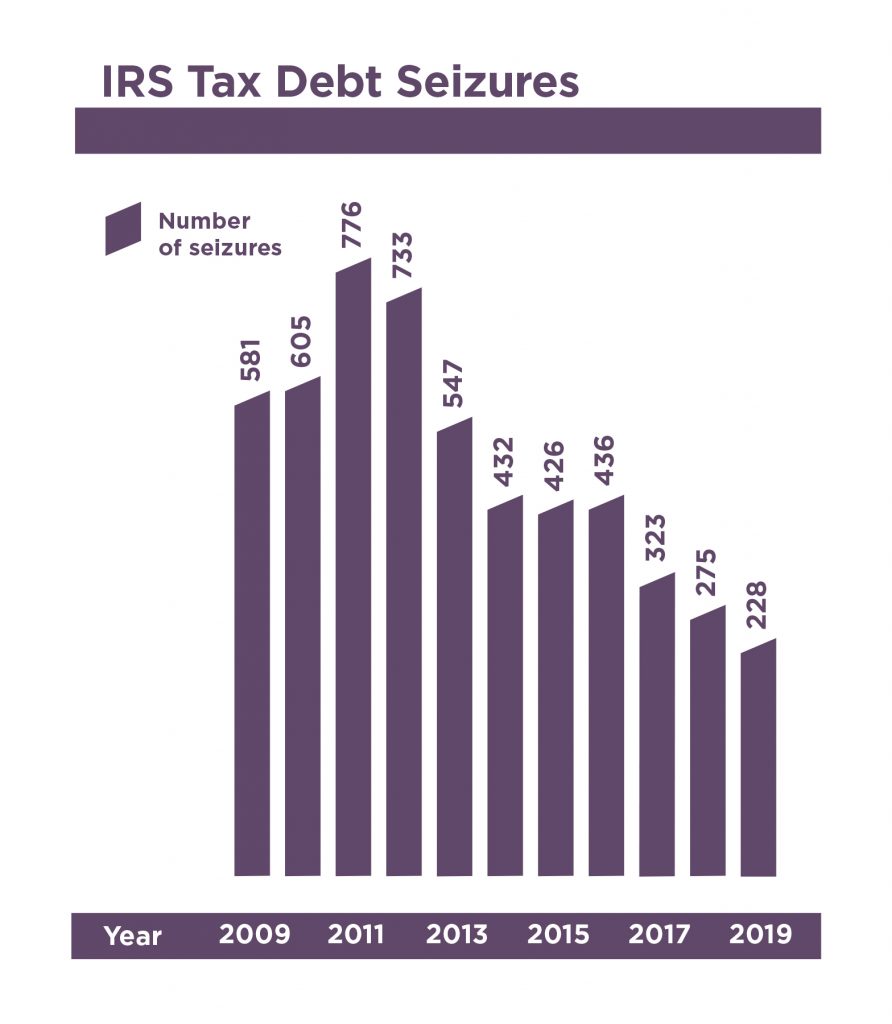

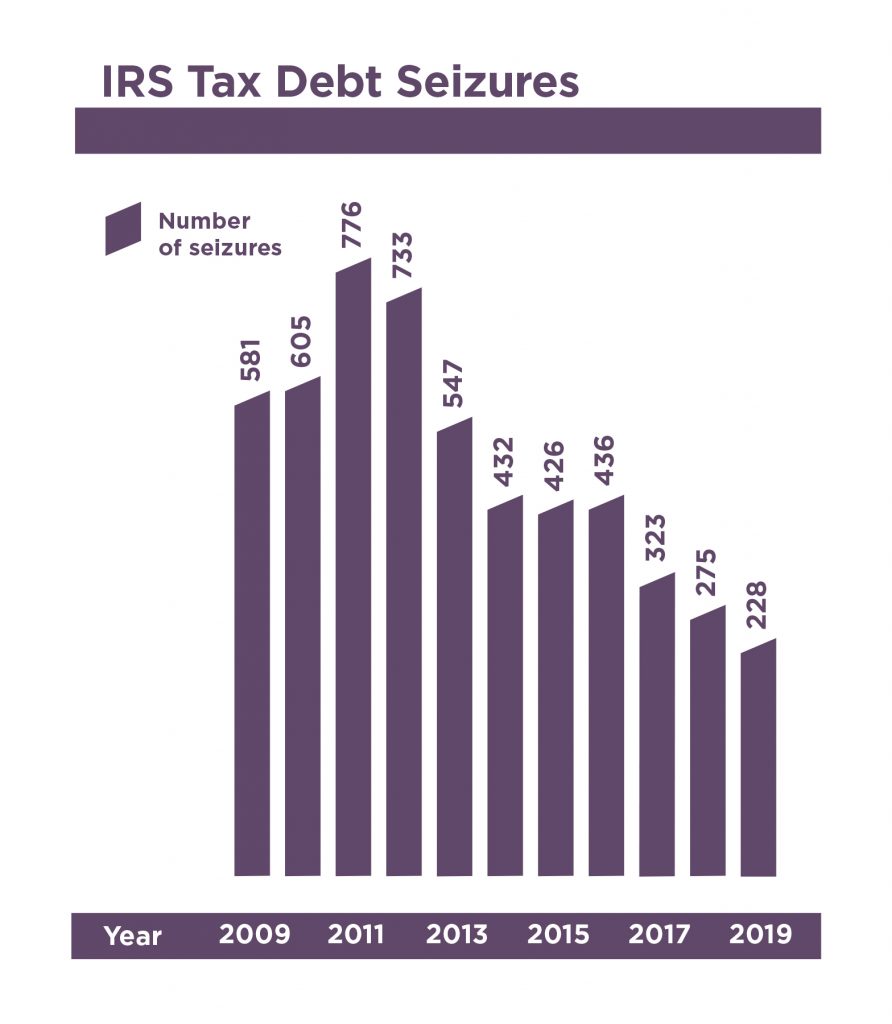

The most drastic method the IRS will take to collect on unpaid taxes is a property seizure. When the IRS seizes an asset, such as a home, car or boat, they can then sell it and use the profit to pay off the amount owed. In order to seize property, the IRS must first place a levy on the property.

Over the past 10 years, the IRS has only completed 5362 property seizures and the yearly number has dropped consistently since 2011, suggesting this is a last resort to collect on back taxes. Though the number of seizures has dropped year-over-year, the percentage of properties actually seized has actually increased marginally from .02% to .03%. This suggests that although the number of

The IRS is required to release a property seizure if it creates an economic hardship, so this is not the preferred method of recourse and is only reserved for the most serious cases where it will not interfere with the taxpayer’s ability to meet basic living expenses.

Delinquent taxpayers have many options to solve their back tax issues, but the Offer in Compromise is one of the most desirable programs, and one of the most effective. The program allows struggling taxpayers to settle their debt to the IRS for less then they owe,

There are qualification requirements for the program, and eligibility for an Offer in Compromise depends on multiple factors, including ability to pay the amount owed, current income, assets owned, monthly expenses and other debts. Taxpayers who qualify can make an offer to the IRS of how much they can reasonably afford to pay, which can sometimes be as little as $1.

See More >> I Paid off $150,000 - How I Did It!

The Fresh Start Initiative, created as a response to help Americans after the 2008 economic crisis, expanded the qualification requirements to allow more taxpayers to utilize the program. Prior to Fresh Start, the IRS did not consider state tax debt and student loans when calculating taxpayers’ discretionary income.

Here is a yearly breakdown of offer in compromise activity over for the past 10 years –

Offers in Compromise Received – 52,000

Offers in Compromise Accepted – 11,000

Dollar Amount of Accepted Offers – $157,261,000

Offers in Compromise Received – 57,000

Offers in Compromise Accepted – 14,000

Dollar Amount of Accepted Offers – $129,668,000

Offers in Compromise Received – 59,000

Offers in Compromise Accepted – 20,000

Dollar Amount of Accepted Offers – $154,092,000

Offers in Compromise Received – 64,000

Offers in Compromise Accepted – 24,000

Dollar Amount of Accepted Offers – $195,652,000

Offers in Compromise Received – 74,000

Offers in Compromise Accepted – 31,000

Dollar Amount of Accepted Offers – $195,379,000

Offers in Compromise Received – 68,000

Offers in Compromise Accepted – 27,000

Dollar Amount of Accepted Offers – $179,354,000

Offers in Compromise Received – 67,000

Offers in Compromise Accepted – 27,000

Dollar Amount of Accepted Offers – $204,748,000

Offers in Compromise Received – 63,000

Offers in Compromise Accepted – 27,000

Dollar Amount of Accepted Offers – $225,946,000

Offers in Compromise Received – 62,000

Offers in Compromise Accepted – 25,000

Dollar Amount of Accepted Offers – $255,862,000

Offers in Compromise Received – 59,000

Offers in Compromise Accepted – 24,000

Dollar Amount of Accepted Offers – $261,286,000

Offers in Compromise Received – 54,000

Offers in Compromise Accepted – 18,000

Dollar Amount of Accepted Offers – $289,422,000

This report examined IRS enforcement activity for unpaid back taxes from the period of 2009-2019, alongside settlement activity for the same time. Enforcement activity reached an all-time high in 2011, following taxpayer hardships caused by the 2008 financial crisis. That year, the IRS introduced the Fresh Start Initiative to help combat the rising number of delinquent accounts as a result of the 2008 financial crash. The introduction of Fresh Start, afforded taxpayers more opportunities to solve their back tax issues and limited the IRS’ ability to utilize judgment options.

As a result, enforcement activity fell consistently for the next 7 years, and settlement activity increased for that period. In 2009, only about 20% of all offers in compromise were accepted by the IRS. By 2016, 43% of offers were accepted. From then on, the acceptance rate once again started to drop and in 2019 only 33% of offers in compromise were accepted by the IRS. Despite the decline in accepted offers, the amount of offers accepted has increased by $132,161,000 from 2009 to 2019.

*2020 numbers are not yet available

*All data for this report was sourced from the IRS Data Book, accessible here.